The Wilkes County Tax Assessor is a vital component of the local government in Wilkes County, responsible for evaluating the value of properties within the county to determine their tax liability. In this article, we will delve into the duties, responsibilities, and significance of the Wilkes County Tax Assessor, providing an in-depth understanding of their role in the taxation process.

Responsibilities of the Wilkes County Tax Assessor

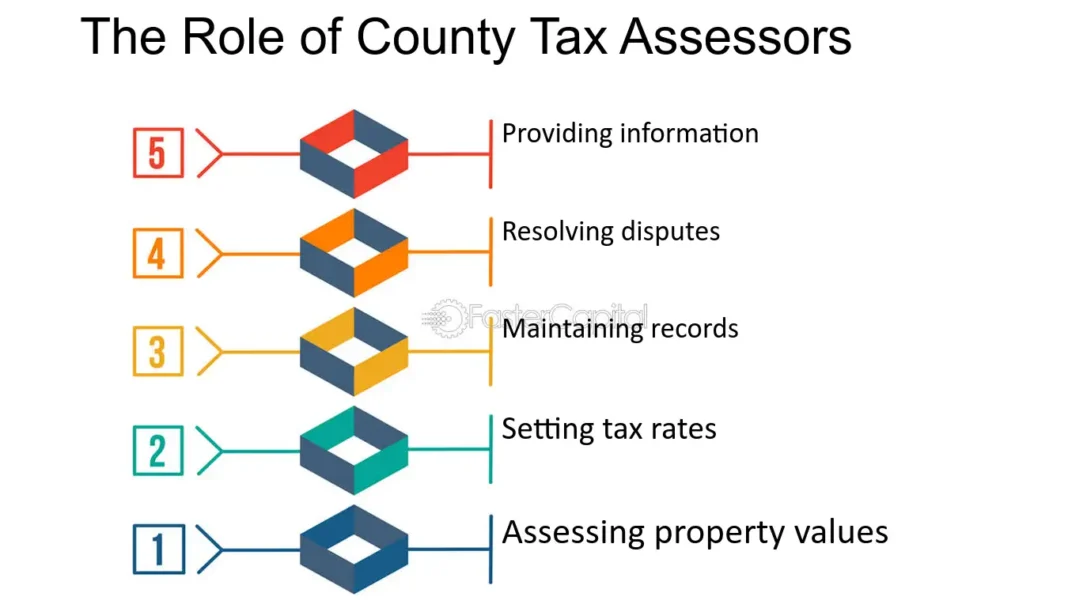

The Wilkes County Tax Assessor is tasked with the following key responsibilities:

-

Property Appraisal: The tax assessor determines the value of all properties in Wilkes County, including residential, commercial, and industrial properties. This involves conducting on-site inspections, reviewing property records, and analyzing market data to determine the fair market value of each property.

-

Tax Roll Creation: The tax assessor prepares the annual tax roll, which lists all properties in the county, their assessed values, and the corresponding tax liabilities.

-

Exemptions and Deferrals: The tax assessor administers exemptions and deferrals for eligible property owners, such as homestead exemptions, veterans’ exemptions, and agricultural deferrals.

-

Appeals and Disputes: The tax assessor handles appeals and disputes from property owners regarding their property values or tax liabilities.

How the Wilkes County Tax Assessor Affects Property Owners

The Wilkes County Tax Assessor’s evaluation of properties has a direct impact on property owners in the county. Here are some ways in which the tax assessor’s role affects property owners:

-

Property Taxes: The tax assessor’s determination of a property’s value directly affects the amount of property taxes owed by the property owner. A higher assessed value results in higher property taxes.

-

Fair Market Value: The tax assessor’s appraisal of a property’s fair market value can impact its sale price or refinancing options.

-

Exemptions and Deferrals: The tax assessor’s administration of exemptions and deferrals can result in significant tax savings for eligible property owners.

How to Contact the Wilkes County Tax Assessor

Property owners in Wilkes County can contact the tax assessor’s office for various purposes, including:

-

Property Value Appeals: Property owners can appeal their property values or tax liabilities by contacting the tax assessor’s office.

-

Exemption Applications: Eligible property owners can apply for exemptions or deferrals through the tax assessor’s office.

-

Property Tax Payments: Property owners can pay their property taxes through the tax assessor’s office.

Conclusion

In conclusion, the Wilkes County Tax Assessor plays a crucial role in the taxation process in Wilkes County. Their evaluation of properties determines the tax liability of property owners, and their administration of exemptions and deferrals can result in significant tax savings. Property owners in Wilkes County should understand the role of the tax assessor and how it affects their property taxes and values. By contacting the tax assessor’s office, property owners can address any concerns or questions they may have regarding their property taxes.