When you’re trading on NYCServers, or any other financial platform, one term you’re bound to come across is slippage. For those new to trading or unfamiliar with the intricacies of the market, slippage can feel like a confusing and potentially frustrating issue. What is it? How does it affect your trades? More importantly, can you avoid it or at least reduce its impact?

Let’s take a deep dive into slippage, specifically within the context of trading on NYCServers, so you can better understand how to manage this often unavoidable aspect of trading.

What is Slippage?

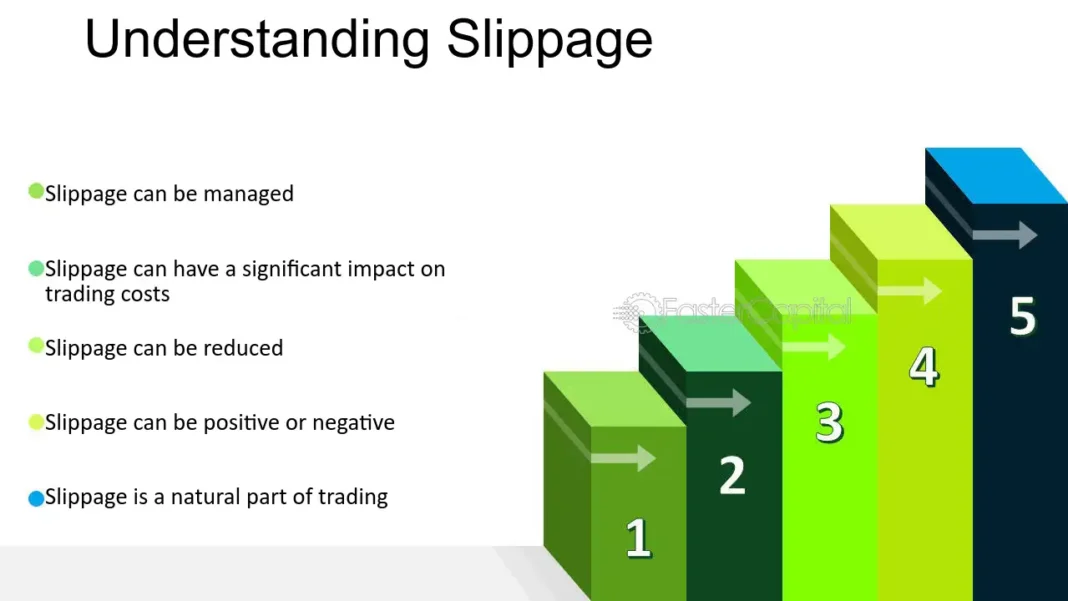

In simple terms, slippage refers to the difference between the expected price of a trade and the actual price at which the trade is executed. It can happen during the buying or selling process and is most commonly experienced in fast-moving markets, where prices fluctuate rapidly.

For instance, you might intend to buy a stock at $100. However, by the time your order is executed, the price might have moved up to $101. That $1 difference is slippage. Similarly, if you’re trying to sell, you may expect to sell at $100, but by the time the transaction goes through, the price could drop to $99.

Slippage can be both positive (you get a better price than expected) or negative (you get a worse price than expected). Most traders, however, are more familiar with the negative side of slippage, as it often leads to reduced profits or higher losses.

Why Does Slippage Happen?

Several factors contribute to slippage, and understanding them can help you better anticipate and manage its effects. Let’s explore the key reasons why slippage happens, especially on platforms like NYCServers.

1. Market Volatility

Slippage is more common in volatile markets, where prices are constantly moving due to fluctuations in supply and demand, market news, or global events. When prices are changing quickly, the price at which your trade gets executed might not match the price you saw just moments ago.

Let’s say a major news event hits, and traders rush to buy or sell. The increased activity can create a gap between the price you expect and the price available when your order is executed, leading to slippage.

2. Order Type and Execution Speed

Different order types can influence the likelihood of slippage. For instance, market orders (orders to buy or sell immediately at the best available price) are more prone to slippage because they prioritize speed over price. If the price moves before your order is filled, you’ll experience slippage.

On the other hand, limit orders (orders to buy or sell at a specific price or better) can help minimize slippage since they only execute at your desired price. However, the downside is that if the market never reaches your limit price, your order won’t be filled.

NYCServers, like most platforms, will execute your orders as quickly as possible, but execution speed can vary based on factors like internet connection, platform load, and market conditions.

3. Liquidity

Liquidity refers to how easily an asset can be bought or sold without causing a significant impact on its price. In highly liquid markets, there are plenty of buyers and sellers, which means trades can be executed quickly with minimal slippage.

However, in less liquid markets, there might not be enough buyers or sellers to match your order immediately. As a result, the platform may need to fill your order in pieces or at different prices, leading to slippage.

4. NYCServers’ Infrastructure and Platform Dynamics

Every trading platform operates with different back-end systems, order matching algorithms, and execution practices. On NYCServers, there may be specific factors related to the platform’s infrastructure that contribute to slippage. For instance, during periods of high demand or server overloads, your trade may take longer to process, increasing the chance of slippage.

It’s important to note that no platform is immune to slippage. While NYCServers aims to execute trades as accurately as possible, it cannot entirely eliminate the risk, especially in fast-moving markets.

The Impact of Slippage on Your Trading

The effects of slippage can range from minor inconveniences to significant financial impacts, depending on the nature of the trade and market conditions. Let’s break down how slippage can impact your trading on NYCServers.

1. Reduced Profits

If you’re trading in fast-paced markets, slippage can eat into your profits. For example, if you intended to buy a stock at $100 and sell at $105, but slippage causes you to buy at $101 and sell at $104, your profit margin shrinks.

In short-term or high-frequency trading, even small amounts of slippage can add up quickly, significantly impacting your overall returns.

2. Increased Losses

Slippage can also increase your losses, especially when you’re trying to exit a losing position. Let’s say you want to sell a stock to cut your losses at $90, but by the time your order is executed, the price has dropped to $88. That $2 difference may seem small, but over multiple trades, it can lead to substantial additional losses.

3. Missed Trading Opportunities

If you’re using limit orders to avoid slippage, there’s a chance that your order might not be filled if the market doesn’t reach your specified price. While this helps you avoid slippage, it also means you could miss out on profitable trading opportunities.

How to Minimize Slippage on NYCServers

While slippage can’t be entirely eliminated, there are strategies you can implement to reduce its impact. Here’s how you can manage slippage more effectively while trading on NYCServers.

1. Use Limit Orders

One of the simplest ways to avoid slippage is by using limit orders instead of market orders. With a limit order, you specify the maximum price you’re willing to pay (for a buy order) or the minimum price you’re willing to accept (for a sell order). This guarantees that your order won’t be executed at a price worse than your limit, though it also means there’s no guarantee your order will be filled.

For example, if you want to buy a stock at $100, you can set a limit order at that price. The order will only execute if the stock reaches $100 or lower.

2. Trade During High Liquidity Periods

Markets tend to have higher liquidity during certain times of the day, such as when major stock exchanges are open or during overlap periods between global markets. Trading during these times can help reduce slippage, as there are more buyers and sellers available, which increases the likelihood of your order being filled at the expected price.

3. Monitor Market Conditions

Slippage is more likely to occur during periods of high volatility, such as after major news events or during market openings. If possible, avoid placing trades during these times, or be prepared for the possibility of slippage. Monitoring the news, staying informed about market conditions, and understanding the timing of economic reports can help you anticipate when volatility—and thus slippage—might occur.

4. Keep an Eye on NYCServers Performance

While NYCServers is designed to handle large volumes of trades, it’s always a good idea to monitor the platform’s performance. If there are any announcements about system updates, server maintenance, or heavy traffic periods, be mindful that this could impact the speed of trade execution and lead to slippage.

5. Use a VPS for Faster Execution

For traders who are particularly sensitive to slippage, using a Virtual Private Server (VPS) can help reduce the delay between placing and executing a trade. A VPS allows you to run your trading platform on a server that’s closer to NYCServers’ data center, reducing latency and potentially minimizing slippage.

Conclusion

Slippage is an inherent part of trading, especially in fast-moving and volatile markets. While it can’t be completely avoided, understanding its causes and implementing smart trading strategies can help minimize its impact.

When trading on NYCServers, be mindful of market conditions, use limit orders when appropriate, and consider using tools like a VPS to improve trade execution speed. By taking these steps, you can better navigate slippage and make more informed trading decisions, helping you protect your profits and reduce losses.