When tax season rolls around, many people find themselves scrambling to file their taxes in the most efficient way possible. With an abundance of tax preparation software available, it can be overwhelming to choose the right one. Two popular options are Keeper Tax and TurboTax. Both have their unique features, advantages, and disadvantages. In this article, we’ll dive deep into the differences and similarities between Keeper Tax and TurboTax to help you decide which is the best fit for your tax preparation needs.

Overview of Keeper Tax

Keeper Tax is a relatively new player in the tax preparation software market, focusing primarily on helping self-employed individuals, freelancers, and small business owners track their expenses and maximize deductions. The platform uses a unique approach by integrating with your bank accounts and credit cards to automatically categorize and track expenses throughout the year. This means you won’t have to scramble to find receipts at tax time. Keeper Tax aims to simplify the process of tax preparation by making expense tracking a year-round habit.

Key Features of Keeper Tax

- Expense Tracking: The standout feature of Keeper Tax is its automated expense tracking. By connecting to your financial accounts, the software can categorize expenses, making it easier to find potential tax deductions.

- Tax Deduction Suggestions: Keeper Tax provides personalized recommendations for deductions based on your expenses, which can be particularly helpful for those who may not be familiar with what they can claim.

- Receipt Scanning: The app allows users to take photos of receipts, which are then stored digitally, reducing the need for paper documentation.

- Tax Filing: While Keeper Tax does allow you to file your taxes directly through the platform, it is more focused on helping you prepare your taxes rather than providing a full suite of filing options.

- Affordability: Keeper Tax is generally more affordable than some traditional tax preparation services, making it an attractive option for freelancers and small business owners.

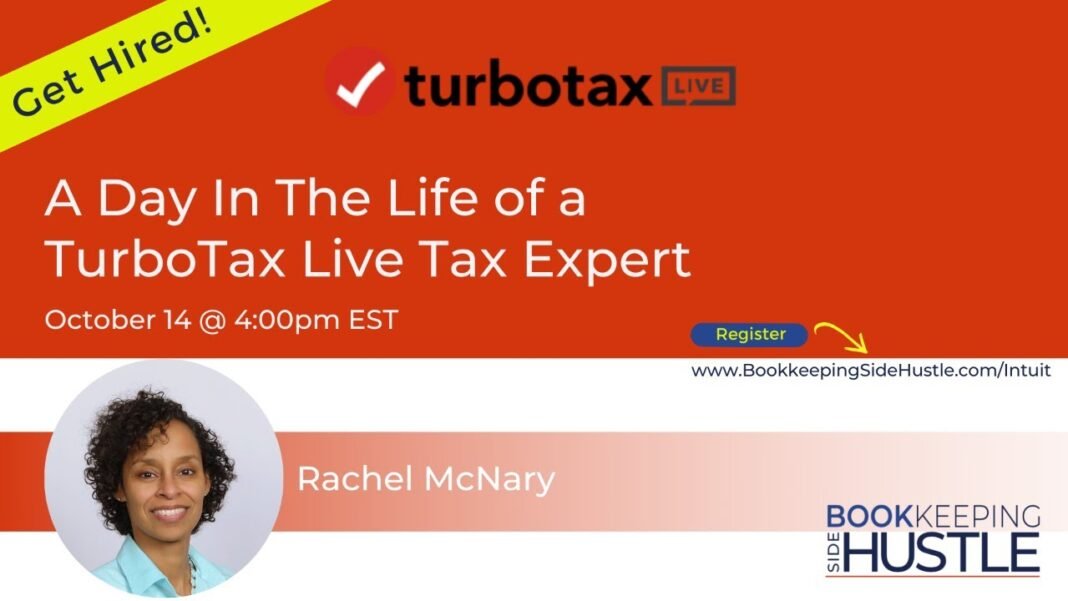

Overview of TurboTax

TurboTax is one of the most recognized names in tax preparation software. Established in the early 1980s, it has become a household name, known for its user-friendly interface and comprehensive features. TurboTax offers a range of products tailored to different types of filers, from simple returns to more complex situations involving multiple income sources and deductions.

Key Features of TurboTax

- User-Friendly Interface: TurboTax is designed to be intuitive, guiding users through the filing process with simple questions and explanations. This makes it accessible for users with varying levels of tax knowledge.

- Comprehensive Deduction Finder: TurboTax employs a robust algorithm to identify potential deductions based on user inputs. It offers a thorough review of available credits and deductions, often resulting in a higher refund.

- Live Support Options: TurboTax provides various support options, including live chat and phone support, as well as an option to connect with a tax professional for personalized guidance.

- Multiple Filing Options: TurboTax offers several packages tailored to different filing needs, from basic individual returns to more complex business and investment filings. This flexibility allows users to choose the package that best suits their situation.

- E-Filing and Tracking: TurboTax allows users to e-file their returns and track the status of their refunds. This feature provides peace of mind, knowing you can monitor your filing’s progress.

Detailed Comparison

1. Target Audience

- Keeper Tax: Primarily aimed at self-employed individuals, freelancers, and small business owners. Its features cater to those who need assistance in tracking and managing their expenses year-round.

- TurboTax: Suitable for a broader audience, including individuals with simple tax situations, families, homeowners, and businesses. Its flexibility allows it to accommodate a wide range of tax scenarios.

2. Expense Tracking and Deductions

- Keeper Tax: Excels in expense tracking through automation. Users can easily categorize their expenses, which is particularly beneficial for those who may forget to keep track of receipts or documentation throughout the year.

- TurboTax: While TurboTax offers a deduction finder, it relies more on user input and may not provide the same level of automation as Keeper Tax. Users must actively input their expenses and income to get the most out of the deduction finder.

3. Ease of Use

- Keeper Tax: The user interface is straightforward and designed for users who want to focus on expense tracking and deductions. However, it may lack some of the comprehensive guides found in more established platforms.

- TurboTax: Known for its user-friendly design, TurboTax provides step-by-step guidance throughout the filing process, making it easy for users to understand what information is needed and why.

4. Cost

- Keeper Tax: Generally more affordable, especially for freelancers and self-employed individuals. It offers a subscription model, allowing users to pay only for the services they need.

- TurboTax: While TurboTax has a free version for simple tax returns, its pricing can escalate quickly for more complex needs. Users may find themselves paying more for additional features or support.

5. Support Options

- Keeper Tax: Offers limited support options, mainly through its app and online resources. While users can find help, the level of personalized support is not as extensive as TurboTax.

- TurboTax: Provides a wide range of support options, including live chat, phone support, and access to tax professionals. This makes it a better choice for users who anticipate needing assistance during the filing process.

6. Filing Capabilities

- Keeper Tax: While it allows users to file their taxes, Keeper Tax is more focused on preparing users for tax season rather than providing a comprehensive filing solution.

- TurboTax: Offers a full suite of filing options, including e-filing, and is built to guide users through the entire tax preparation process. This makes it a more robust choice for those who want an all-in-one solution.

Which One is Right for You?

Choosing between Keeper Tax and TurboTax ultimately comes down to your individual needs and preferences.

- Choose Keeper Tax If:

- You are self-employed or a freelancer and need help tracking expenses year-round.

- You want a more affordable option focused on maximizing deductions.

- You prefer automated expense tracking and receipt scanning.

- Choose TurboTax If:

- You have a more complex tax situation or a variety of income sources.

- You want an intuitive interface with comprehensive guidance throughout the filing process.

- You anticipate needing customer support or professional assistance.

Conclusion

Both Keeper Tax and TurboTax offer unique benefits that cater to different audiences. If you’re a self-employed individual looking for streamlined expense tracking and deduction optimization, Keeper Tax may be your best bet. On the other hand, if you prefer a more comprehensive tax filing solution with extensive support options, TurboTax is the way to go. Ultimately, it’s about finding the right fit for your specific tax situation and preferences. Whichever you choose, both platforms aim to simplify the often overwhelming process of tax preparation, allowing you to focus on what really matters—your finances and your business.